Cryptocurrency regulation updates US: What you need to know

To prepare for cryptocurrency regulation changes, businesses should stay informed, regularly review compliance protocols, educate staff, and consult legal experts to navigate the evolving landscape effectively.

Cryptocurrency regulation updates US are crucial for anyone involved in the digital currency space. With laws evolving quickly, it’s essential to understand the landscape and its implications for investors and businesses. Are you ready to navigate this complex environment?

Key regulations affecting cryptocurrency in the US

Understanding the key regulations affecting cryptocurrency in the US is vital for anyone in the digital asset space. These regulations shape how cryptocurrencies are traded, taxed, and used in transactions. Recently, various federal and state-level regulations have emerged, aiming to create a safer environment for investors and businesses.

The role of the SEC

The Securities and Exchange Commission (SEC) is a significant player in regulating cryptocurrencies. Their decisions influence market behavior and investor confidence. For instance, the SEC has established criteria for determining whether a cryptocurrency is a security. This classification affects how these assets are treated under the law.

- Compliance with securities laws is mandatory for certain cryptocurrencies.

- The SEC’s actions can lead to enforcement against non-compliant entities.

- New guidelines are being proposed regularly to keep pace with innovations.

Moreover, compliance with Anti-Money Laundering (AML) and Know Your Customer (KYC) regulations is crucial. Financial institutions dealing with cryptocurrencies must implement robust systems to monitor and report suspicious activities. This requirement helps prevent illicit activities while promoting transparency.

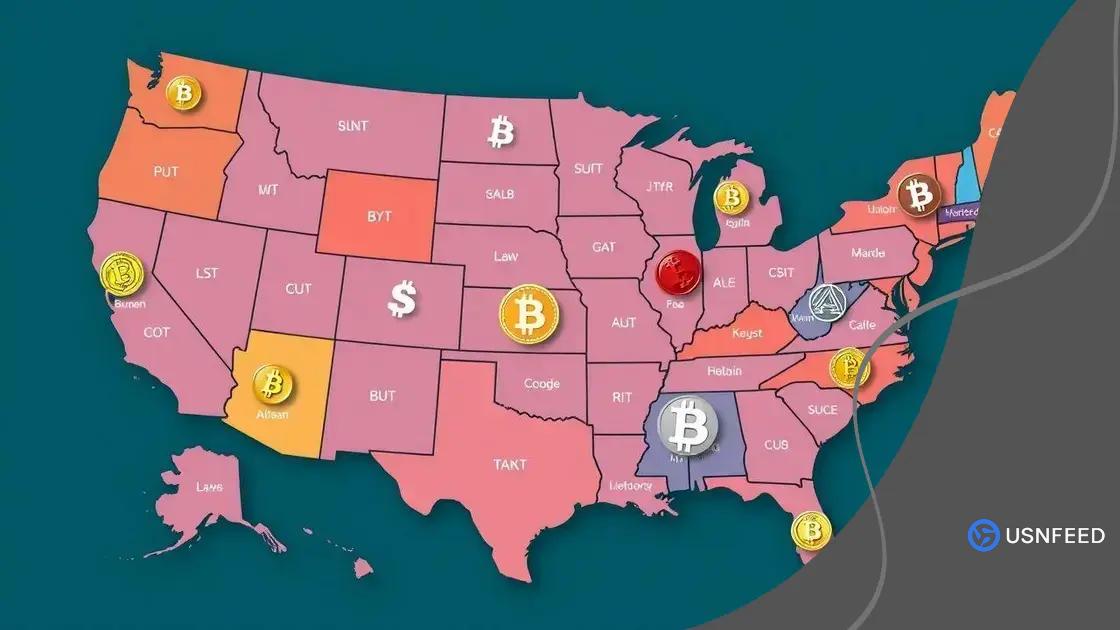

State-level regulations

States also impose their own regulations affecting how cryptocurrency operates within their jurisdiction. For example, some states require specific licenses for cryptocurrency exchanges. Other states have adopted more lenient approaches, promoting a more business-friendly environment. This fragmented landscape can be challenging for entrepreneurs looking to navigate the regulatory environment.

- Some states, like Wyoming, are known for their crypto-friendly laws.

- Others, such as New York, have stricter licensing requirements.

- Understanding state regulations is critical for companies operating in multiple states.

The evolving nature of cryptocurrency regulations highlights the importance of staying informed. Changes in policies can affect trading practices and market dynamics. Regularly reviewing updates and understanding their implications can help investors and businesses make better decisions in the cryptocurrency market.

Impact of SEC actions on digital assets

The impact of SEC actions on digital assets is profound and far-reaching. As the main regulator of securities in the United States, the SEC plays a crucial role in shaping the landscape for digital currencies and tokens. Investors and companies alike need to understand how SEC decisions influence market dynamics and the overall adoption of cryptocurrencies.

Effects on Market Stability

When the SEC makes announcements or takes enforcement actions, it often leads to immediate reactions in the market. For example, a crackdown on unregistered securities can cause volatile price fluctuations. This volatility can unsettle investors, leading them to question their holdings or even withdraw from the market.

- Market confidence is commonly swayed by SEC regulations.

- Increased scrutiny can lead to more compliance among cryptocurrency projects.

- Long-term effects could establish more stable market conditions as regulations mature.

Moreover, the SEC’s categorization of assets as securities or commodities can fundamentally alter how they are traded. When a cryptocurrency is designated as a security, it must comply with various regulations. This can include registration, disclosure requirements, and adherence to trading protocols. Companies must invest in legal resources to navigate these complexities, influencing their operational strategies.

Encouraging Compliance

Through its actions, the SEC encourages companies to prioritize compliance. As organizations align their practices with regulatory expectations, they cultivate trust among investors. A compliant ecosystem fosters a healthier market for all participants.

- Companies are more likely to adopt best practices.

- Investors gain confidence in the legitimacy of projects.

- Long-term success is linked to compliance and transparency.

The impact of SEC actions extends beyond immediate market responses. It shapes industry norms, sets standards for operations, and influences public perception of the cryptocurrency space. Understanding these dynamics is essential for anyone involved in digital assets, from investors to developers.

State-by-state approach to cryptocurrency laws

The state-by-state approach to cryptocurrency laws reflects the varied regulatory landscape across the United States. Each state has the authority to craft its own regulations, which can lead to significant differences in how cryptocurrencies are treated. This patchwork of laws creates both opportunities and challenges for businesses and investors.

The Diverse Regulatory Landscape

Some states, like Wyoming, have adopted a very friendly stance towards cryptocurrencies, promoting innovation and creating favorable conditions for blockchain companies. On the other hand, states such as New York have implemented stricter regulations, requiring businesses to obtain licenses before operating.

- Wyoming offers tax incentives and clear guidelines for cryptocurrencies.

- New York’s BitLicense requires compliance with strict consumer protection standards.

- California focuses on both innovation and consumer safety in its regulatory framework.

This diversity often leads to questions about which regulations companies should follow when operating across multiple states. Understanding local laws is crucial for businesses to remain compliant and avoid penalties.

Challenges of Compliance

Companies face hurdles when adapting to different regulations in each state. Compliance costs can become burdensome, especially for startups trying to navigate a complex legal environment. Additionally, the constant updates to laws require companies to stay vigilant.

- Businesses must invest in legal resources for compliance.

- Staying updated on changes is necessary to avoid legal issues.

- Cross-border operations require careful planning to meet diverse regulations.

The state-by-state approach signifies the ongoing evolution of cryptocurrency regulations. As more states introduce laws, the regulatory environment will likely continue to develop, impacting how businesses operate and how consumers engage with digital assets.

Future trends in cryptocurrency regulation

The future trends in cryptocurrency regulation are becoming a focal point for industry watchers and investors alike. As digital currencies continue to grow, the regulatory landscape is evolving to address emerging challenges and opportunities.

Increased Global Cooperation

One major trend is the growing interest in international collaboration among regulatory bodies. Countries are beginning to recognize the need for consistent regulations worldwide. This can help streamline compliance for businesses that operate across borders.

- Agreements between countries may lead to standardized rules.

- Collaboration can prevent regulatory arbitrage.

- Shared insights can foster innovation while safeguarding consumers.

Additionally, the emergence of global standards can enhance consumer confidence in digital assets. Investors are more likely to engage with cryptocurrencies that have clear fraud prevention frameworks.

Technological Innovations

Another trend is the incorporation of technology into regulatory practices. Regulatory technology, or regtech, is gaining traction. Innovations such as blockchain-based identity verification and automated compliance systems promise to make the regulation of cryptocurrencies more efficient.

- Regtech solutions can help businesses comply with KYC and AML requirements.

- Advanced monitoring tools can identify suspicious activities in real time.

- Blockchain can provide transparency and accountability in transactions.

As regulations become more tech-driven, companies will need to adapt to maintain compliance. This shift could foster a more transparent and secure environment for all participants in the cryptocurrency market.

Focus on Consumer Protection

Regulatory bodies are increasingly prioritizing consumer protection. There is a strong push to implement measures that ensure investors are safeguarded from fraud and scams. This focus may lead to stricter penalties for dishonest practices in the crypto space.

- Investor education will become essential in new regulations.

- Protections could include clear disclosure requirements for crypto offerings.

- Agencies might increase surveillance of fraudulent activities.

The future of cryptocurrency regulation appears to be heading toward a more cohesive framework. With global cooperation, technological advancements, and an emphasis on consumer safety, the regulatory environment will likely become more structured, benefiting both investors and businesses.

How to prepare for regulatory changes

Preparing for regulatory changes in the cryptocurrency space is essential for businesses and investors alike. As regulations evolve, being proactive can help navigate the complexities and reduce potential risks. Understanding the likely shifts in the legal landscape will ensure that all stakeholders are ready.

Stay Informed

The first step in preparation is to stay updated with the latest news and regulations. Following credible sources, subscribing to newsletters, and engaging with industry forums is vital. This practice allows individuals and organizations to anticipate upcoming changes.

- Monitor updates from regulatory agencies like the SEC.

- Participate in cryptocurrency conferences and webinars.

- Join professional networks for real-time alerts on regulatory developments.

Accessing diverse perspectives from fellow professionals can also provide valuable insights into potential impacts.

Review Compliance Protocols

Regularly reviewing compliance protocols is an important part of preparation. Companies should assess their current practices to ensure they align with existing regulations. This may include updating internal policies or investing in compliance software to monitor transactions effectively.

- Conduct regular audits to identify gaps in compliance.

- Update KYC and AML procedures to align with new regulations.

- Train staff on the importance of compliance and new procedures.

Making compliance a priority helps mitigate risks and builds trust with customers and regulators alike.

Educate and Train Staff

Ensuring that employees are informed is key to a smooth transition during regulatory changes. Conducting training sessions can prepare team members for new legal requirements and enhance their understanding of compliance protocols. Accessible resources and clear guidelines will empower staff to handle transactions diligently.

- Provide regular training on regulatory changes impacting operations.

- Share updates and educational materials with the entire team.

- Encourage employees to ask questions and seek clarification.

Personnel who fully grasp compliance expectations can contribute to a more robust framework for adhering to regulations.

Engage with Legal Experts

Consulting with legal experts who specialize in cryptocurrency regulations can provide invaluable support. These professionals can offer tailored advice on how to adjust to regulatory changes. Building relationships with legal advisors will equip businesses with the knowledge needed to navigate the evolving landscape effectively.

- Consider engaging a regulatory compliance consultant.

- Keep an ongoing relationship with legal advisors for quick consultation.

- Attend legal workshops focused on cryptocurrency regulations.

By preparing for regulatory changes, businesses and investors can enhance their resilience in the ever-changing cryptocurrency landscape.

In conclusion, navigating the evolving world of cryptocurrency regulations requires awareness and preparation. By staying informed about regulatory changes, reviewing compliance protocols, educating staff, and engaging with legal experts, businesses and investors can confidently adapt to new laws. These proactive steps will not only help in maintaining compliance but also foster trust and stability in the cryptocurrency market. Embracing change and being ready for the future will ensure that participants in the industry are well-prepared for whatever lies ahead.

FAQ – Frequently Asked Questions about Cryptocurrency Regulation

What are the key steps to prepare for cryptocurrency regulatory changes?

Key steps include staying informed about updates, reviewing compliance protocols, educating staff, and consulting with legal experts.

Why is staying informed about regulations important?

Staying informed helps businesses anticipate changes, adjust their operations, and avoid potential legal issues.

How can technology help in compliance with cryptocurrency regulations?

Technology can provide tools for automated compliance, monitor transactions, and ensure adherence to KYC and AML requirements.

What role do legal experts play in navigating regulatory changes?

Legal experts provide tailored advice, help interpret regulations, and guide businesses through complex compliance challenges.